About the Program

The IFC-Milken Institute Capital Markets Program is an accredited, 8-month, graduate-level certificate program reaching financial professionals across 40 countries and counting. The program blends academic rigor with hands-on work experience in the US financial industry, exclusive interaction with private-sector players and market regulators, and unprecedented networking opportunities with the next generation of leaders across developing and emerging economies. Program alumni are already laying the groundwork for growth and business opportunity around the world.

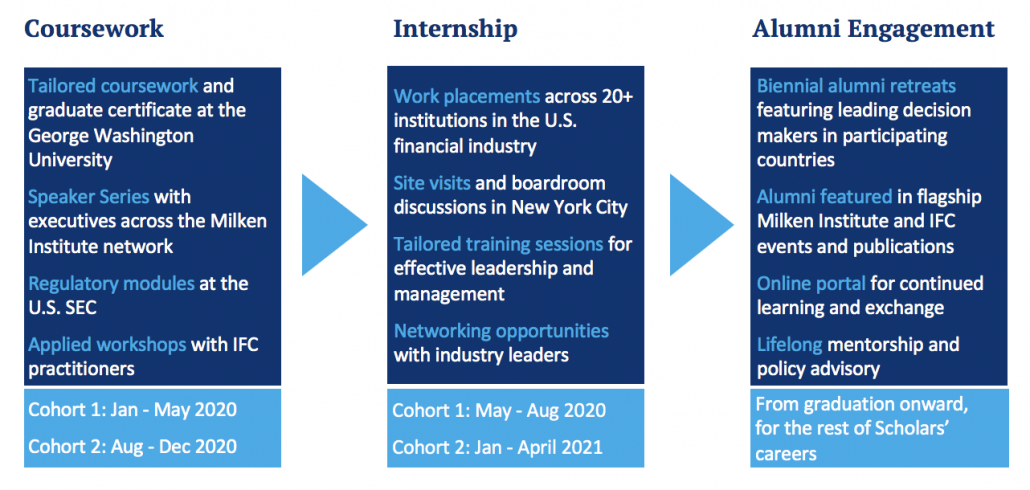

Program Components

Coursework

The coursework lasts four months. Taught by a top-ranked DC based University, this portion of the program includes four classes (for 3 credits each):

- Capital Markets, Instruments and Institutions

- Corporate Finance& Risk Management

- Capital Markets, Financial Crises & the Global Economy

- Quantitative Thinking for Policymakers

Tailored Workshops

Supplementary hands-on modules further prepare participants for the realities of investment analysis and policy implementation. Modules include:

- Weekly IFC-Milken Institute Speaker Series, delivered by prominent guest practitioners from public and private sectors

- Series of regulatory workshops hosted at the U.S. Securities & Exchange Commission

- Case-studies and group exercises hosted at the IFC

- Workshops in leadership and professional development

Internships

Following the completion of the core courses, Scholars spend 4 additional months putting what they have learned into practice across the financial industry in the United States. Internships are hosted across a range of institutions, including:

- Private equity & venture capital firms

- Hedge funds & asset managers

- Banks & other financial services institutions

- Development Finance Institutions

Alumni Network

Upon graduating, participants become part of an international alumni network of policymakers and market practitioners. Active online and in-person, this network is a key source of peer support and advice as alumni go on to play pivotal roles in advancing the development, management, and integration of their capital markets. Engagement includes:

- Online alumni portal

- Group work and continued learning

- Publication opportunities

- Access to policy roundtables and bespoke events throughout the year

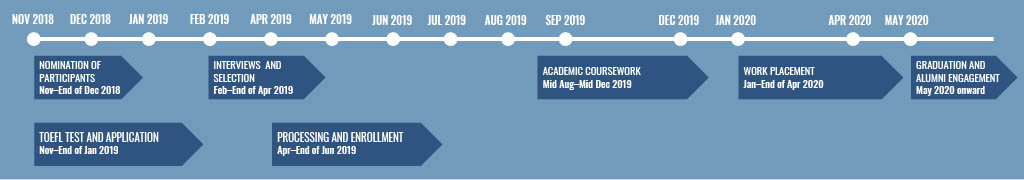

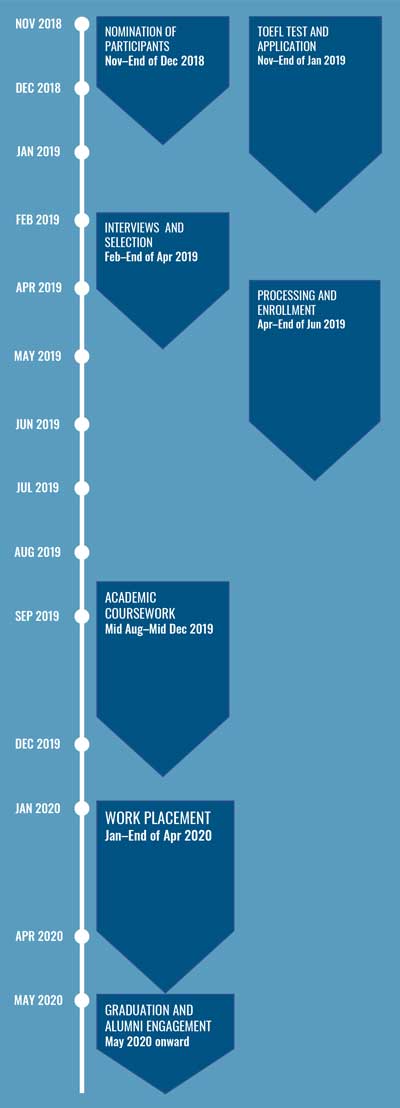

Timeline

Nomination Process

- We encourage employers to nominate program participants (2-5 motivated men and women within each organization, who are mid-career and have the potential to contribute effectively to capital-market development upon return)

- The application process is highly competitive and lasts several months. The admissions committee generally selects 1-3 qualified participants from each country, based on the quality of their applications and interviews

- Selected employees will spend eight months in the United States to participate in the program consisting of two consecutive parts: classroom sessions and workplace training in the US financial industry

- During the eight-month period, selected employees must be paid their regular salary to be eligible to participate in the program. Employers are also expected to help participants cover their living expenses for the first part of the program (estimated at $16,500)

- Participants will receive an academic certificate accredited by the university upon successful completion of the academic coursework

- Participants are expected to return to their current employment for at least two years after completion of the program, with a clear path for career progression and with a view to contributing effectively to the operations of the organization, and further development of local capital markets

- All IFC-Milken Institute Scholars will gain access to the IFC-Milken Institute Alumni Network (including shared online resources, invitations to participate in alumni events, conferences and other outreach events, advisory support, etc.) post completion of the program

Program Costs

- For a select group of 20-25 applicants from developing economy governments, the IFC and Milken Institute will award scholarships to completely cover tuition costs (currently estimated at $25,000 per participant).

- All living expenses in the first semester must be covered by the participant and/or the current employer. This includes housing, travel, living, books, and the visa processing fee. Combined, these expenses are estimated at around $16,500 for living in Washington DC. Meanwhile, living expenses in the second part of the semester are covered by the internship stipend.

- In addition, all home country employers are required to continue paying participants their regular salaries for the duration of the program, so that they can focus on the learning experience.

- Scholarship funding is contingent on all participants returning to their home countries and institutions to work in domestic capital markets for a minimum of two years after completing the program. Funding is subject to claw-back conditions if this does not take place.

- Applicants from the private sector or from wealthier countries (upper-middle-income and above, according to the World Bank Group classification) are not eligible for tuition scholarships. For these applicants, the full cost of the program (living expenses and tuition) is therefore approximately $41,500. For visa reasons, these applicants need to secure at least partial cost coverage by their employers or another external institution (which will have to cover at least 51% of this amount).